A year has passed from the establishment of the National Unity Government (NUG); however, the country’s economic situation is not going towards right direction as the NUG’s leaders had promised during the Afghan presidential elections. According to a recent survey by the Asia Foundation, 58% of Afghans think that the country is going on the wrong direction regarding security, corruption, good governance and economy. The top four problems that the Afghan government faces are insecurity, corruption, unemployment and poor economic situation and the most frequently cited local problems are unemployment, illiteracy, poor economic situation and lack of higher education opportunities[1].

In the economic field, Afghani (Afghan currency) is depreciating against USD day by day and the investment in the country is decreased as compared to the previous years. The question is that Why Afghani depreciates and why investment is decreasing in the country? They are discussed here.

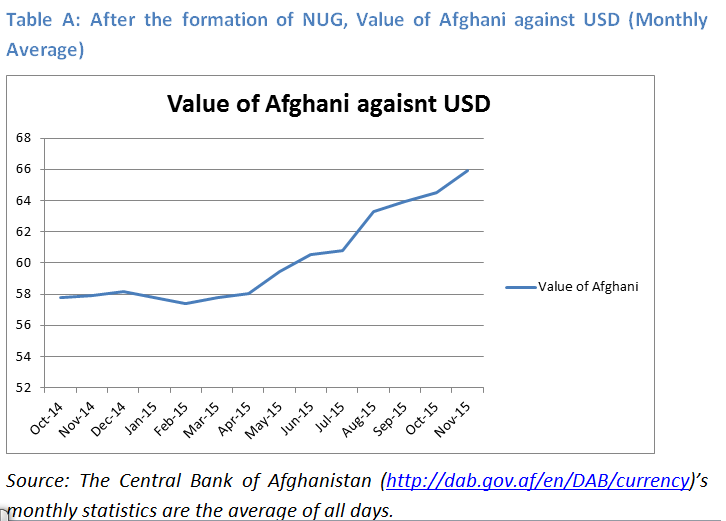

The Value of Afghani in the Last Year

After the first round of presidential runoff elections in April 2014, the monthly average rate of Afghani was 57.22 Afghani against dollar[2]. At the end of the long process of the elections, the monthly average was 57.1 in September; however, after the formation of NUG until the end of 2014, the monthly average value of Afghani against USD was 58.18. The value of Afghani against USD got better in the first two months of 2015 again. The monthly average value of Afghani against USD got better (57.76) and (57.4) in January and February respectively.

After the first two months of 2015, Afghani was depreciated gradually and it is descending now. A USD has valued 67.25 Afghanis in the last week of November. (See, Table A)

The Depreciation of Afghani (Currency)

The factors behind depreciation of Afghani are as following:

First: Increase in the value of USD in the international market: Deprecation of Afghani against USD is not limited to Afghanistan only, but the value of USD, in the international market, has increased against foreign currencies compared to the last 40 years. If we consider the value of USD against Euro in the last 12 months, the value of USD has increased. For instance, a USD valued 0.81 Euro in December 2014 but, after a year, it values 0.92 Euro in November 2015[3]. Similarly, the value of USD is also increased against other currencies.

Second: The Poor Economic Situation: The country’s current poor economic situation, where the rate of unemployment has increased compare to the last 14 years, and there is a wide gap between exports and imports (huge trade deficit), investment is decreasing, the security situation is facing challenges and due to the depreciation of Afghani, the demand for other currencies is also on the rise; so these factors has impacts on depreciation of Afghani, also.

Third: The Artificial Value of Afghani: The value of Afghani was not high due to economic situation of the country in the past 14 years, but it has an artificial aspect rather. Whenever Afghani was depreciating against USD, the government supplied USD to the market and instead was collecting Afghani. Considering the Demand and Supply principles, the value of Afghani was decreasing as a result of shortage of Afghani and profusion of USD. However, the rate of currencies is based on demand and supply principles; but it is related to the ground of exports and imports rather.

Fourth: Fleeing of Afghan Youth to Europe: Since the Afghan youth are started to flee to Europe through illegal ways, so they deal with smugglers on USD, which has increased the demand for USD from one hand and, on the other hand, as a large part of these USD go outside the country, so it causes lack of USD in the country, also. It is why the value of USD against Afghani has increased.

Fifth: The Lack of Demand for Afghani in the Market: At the start, a lot of Afghans were working with foreigners and foreign organizations and so they were receiving salary with USD. They were supplying this USD to the market and were receiving Afghani in exchange. This process which included the demand for Afghani and besides that, the Afghan government was also supplying USD to the market in order to appreciate the Afghani, so this was increasing the demand for Afghani in the market which spontaneously was keeping the value of Afghani high. Now, as a lot of NGOs are closed or their works are shortened, so, the demand for Afghani has decreased in the market, also.

The Investment Situation

Generally, in a backward community, and especially in a post-war-torn country, most of the investment is concentrated on construction works (like building houses, roads, shops and etc.), agriculture, services and industries. Afghanistan was not an exception in this regard, either. In the last 14 years, most of the investment was focused on construction works, services and industries. Investment in the sectors of construction work, services and industries are dependent on security to a larger extent. However when the security is provided well and the predictions for its breach are low; naturally, then, more investment would be done in these fields.

Therefore, the current year’s insecurities have negatively impacted the investment in Afghanistan. Afghanistan Investment Support Agency (AISA) believes that investment is decreased by 26% in the first 9 months of 2015 compare to the first 9 months of 2015. Almost $611 million was invested in Afghanistan in the first 9 months of 2014; however, it decreased to $448 million in the first 9 months of 2015.

Investment in construction field is decreased to $83 million in the first 9 months of 2015, in the case, it was $200 million in 2014, which shows a 58% decline compare to the last year. Moreover, investment in the fields of industry, agriculture and services decreased by 25%, 12% and 9.63% respectively.

Reasons behind Decline in Investment

The reasons behind decline in investment in the current year are as following:

First: Insecurity: Mostly, insecurity is the main reason that prevents foreign big investors to invest in Afghanistan. Moreover, insecurity has prevented domestic investors from doing investment in the country, also, According to the latest report of AISA, investment in the most secure area of Afghanistan (Kabul) is not only decreased but it is increased, also. $249 million were invested in Kabul in first 9 months of last year; however, this amount increased to $273 million in first 9 months of 2015[4].

Second: Political Instability: The long process of presidential runoff elections, late formation of the Cabinet and internal disputes of NUG have deeply impacted the rate of investment in the current year.

Third: Corruption and Bribery: Corruption and bribery are one of the factors that prevent investment in the country. Now, some rumors are broadcasted on the media that Telecommunication Companies provide armed men with bribes in order to safeguard their buildings.

Fourth: The Lack of Electricity: The Lack of electricity is a barrier in the front of industrial activities in the country. For example, almost the entire factories in the Kandahar Industrial Park stopped their activities due to the lack of electricity[5].

[1] See online: http://asiafoundation.org/publications/pdf/1558

[2] See online: http://dab.gov.af/en/DAB/currency

[3] See online: http://www.ozforex.com.au/forex-tools/historical-rate-tools/monthly-average-rates

[4] See online: http://www.bbc.com/persian/afghanistan/2015/10/151031_k05_afghanistan_aisa_investment_decreased

[5] See online: http://pa.azadiradio.mobi/a/26957266.html